QuickBooks Integration

A step by step guide on how to set up an API integration with QuickBooks

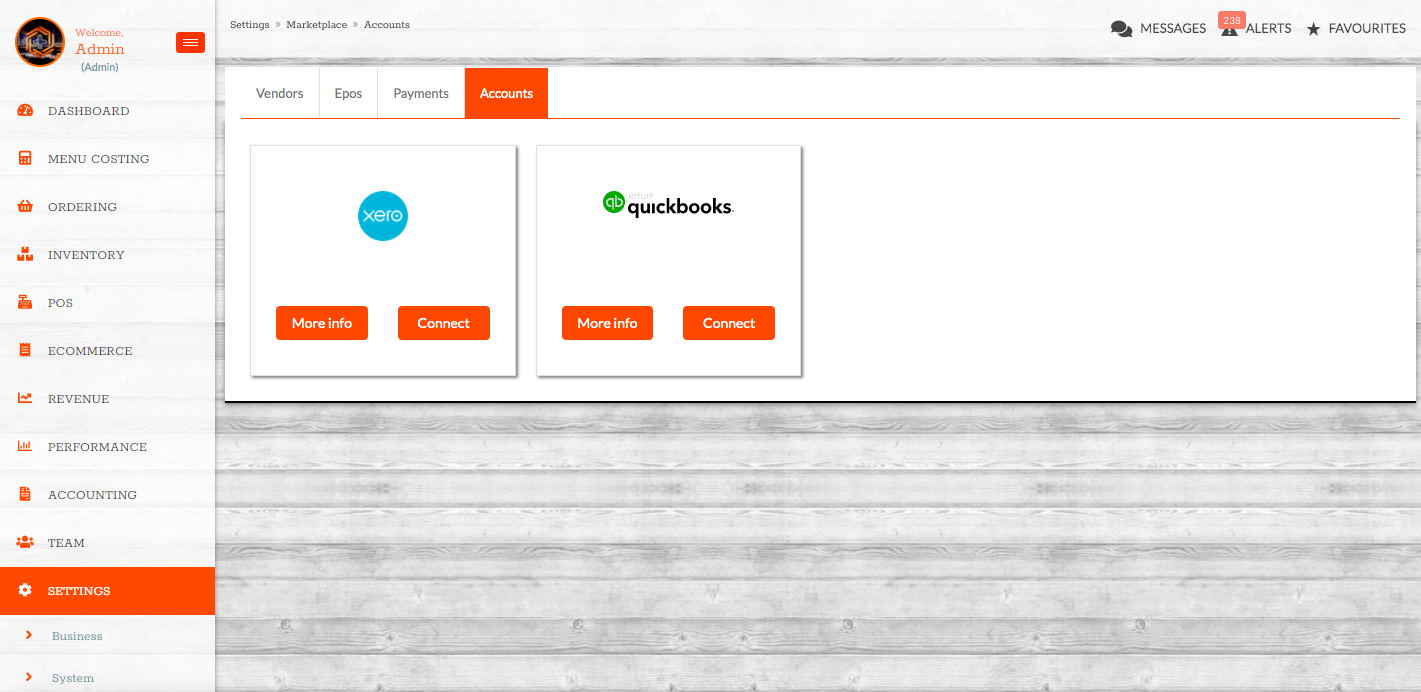

1. Connecting up

Navigate to 'settings' > 'Marketplace' > 'Accounts' > Quickbooks - Connect

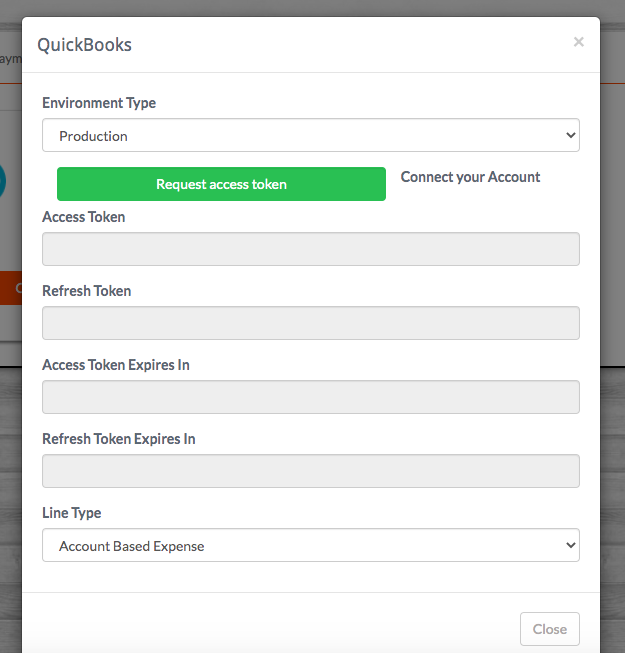

From here - 'Request token'

At this point the system will redirect to QuickBooks. If you are already logged in to your QuickBooks account it should automatically connect.

If you are not logged in it will prompt you to do so, and you will be prompted to allow data-sharing between the two platforms.

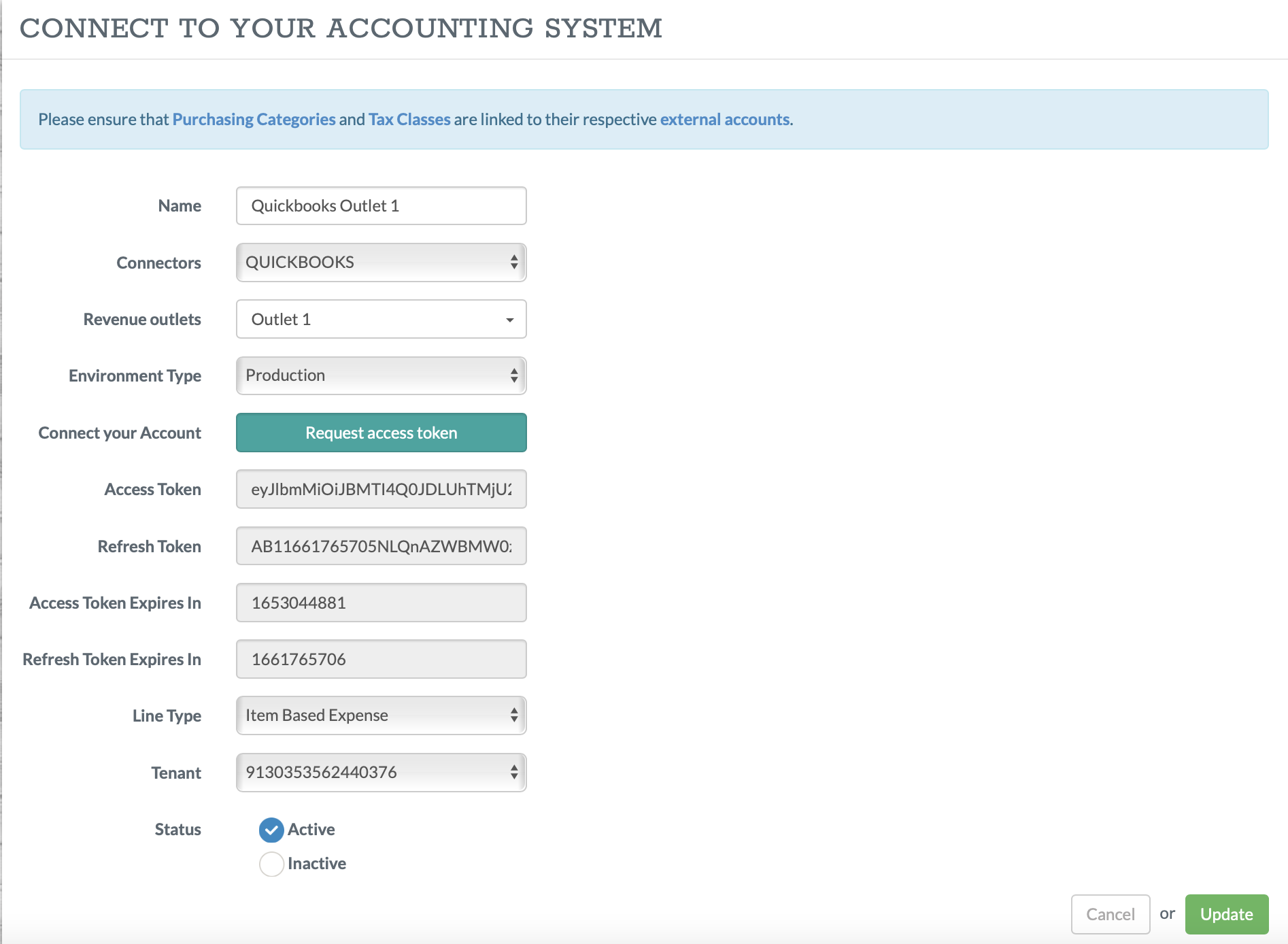

Once done, you'll be returned to KitchenCut, on the page screenshot below.

You'll need to give this connection a name, and specify the Revenue Outlet(s) you want to be connected to this Quickbooks account. Ensure the Environment Type is set to 'Production', choose your 'Line Type' and ensure the Status is 'Active', then hit 'Create/Update'.

2. Reviewing the settings

It is important to ensure purchasing categories and tax codes are aligned;

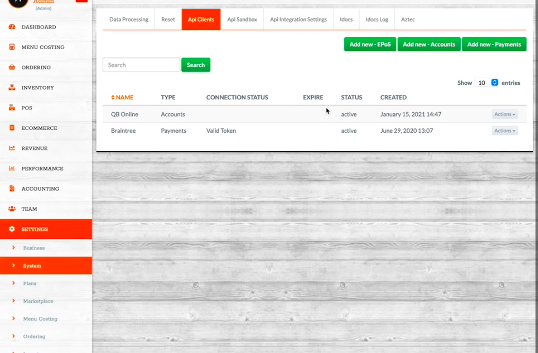

Head to Settings > System > Api clients where QuickBooks should now appear as 'QB online'

Under 'Actions' - you will be able to ensure the external settings align;

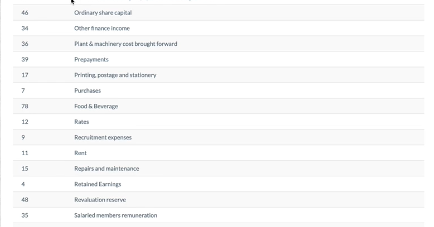

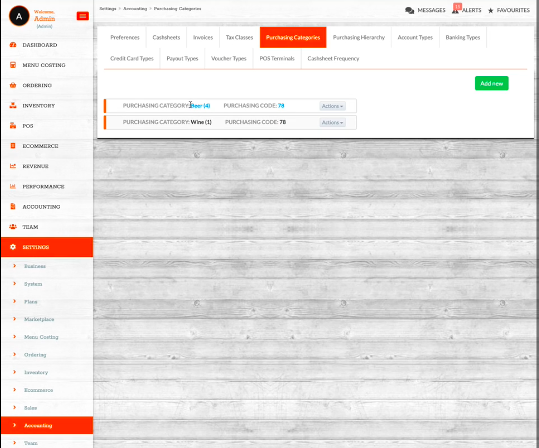

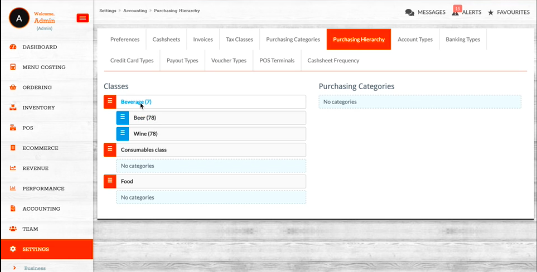

i) Purchasing categories need to match what is in QuickBooks chartered accounts;

e.g. Food & Beverage 78

Check and compare against Kitchen CUT by going to Settings >Accounting > Purchasing Categories > Confirm Accounting Code

With the below example you can see Beer & Wine are set up as code 78

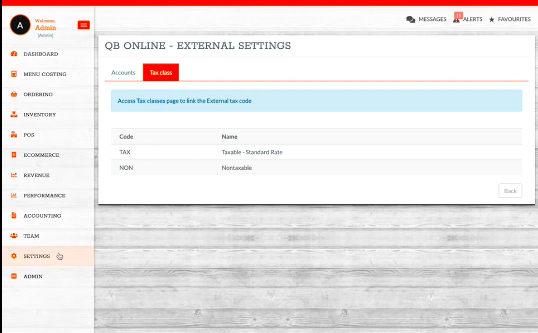

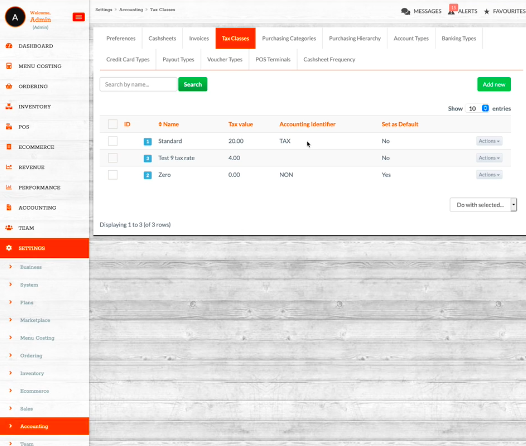

ii) Tax Classes

Same process as Purchasing categories but found under the 'Tax Class' Tab

In the below example you can see there are two Tax codes set up in QuickBooks

Again; these will need to match what is in Kitchen CUT by going to Settings >Accounting > Tax classes; review the 'Accounting Identifier'

N.B - you will need to ensure any new category or purchasing class you create, matches up to the corresponding code in QuickBooks

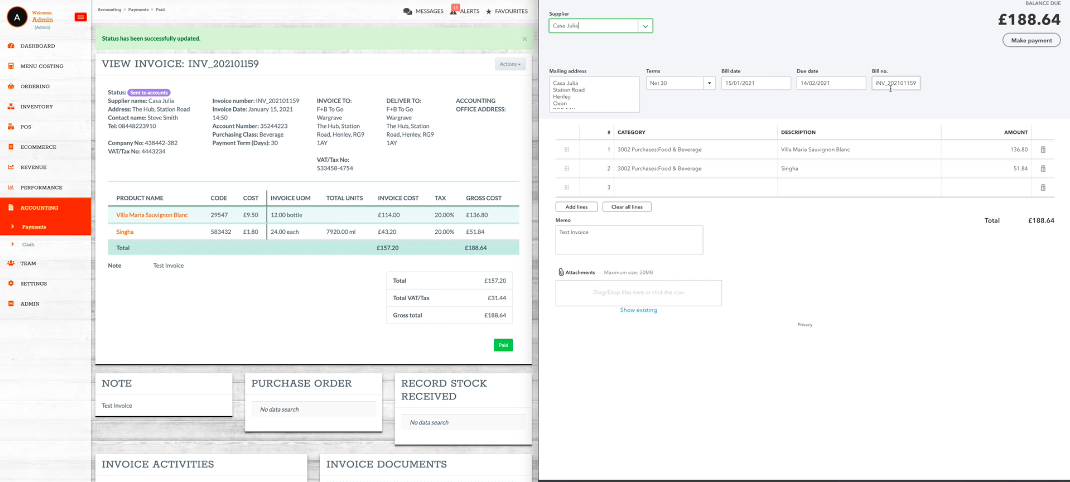

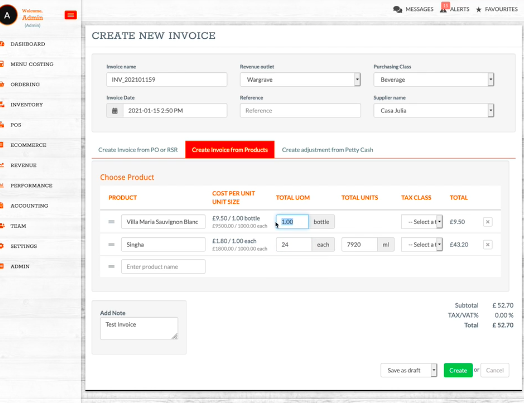

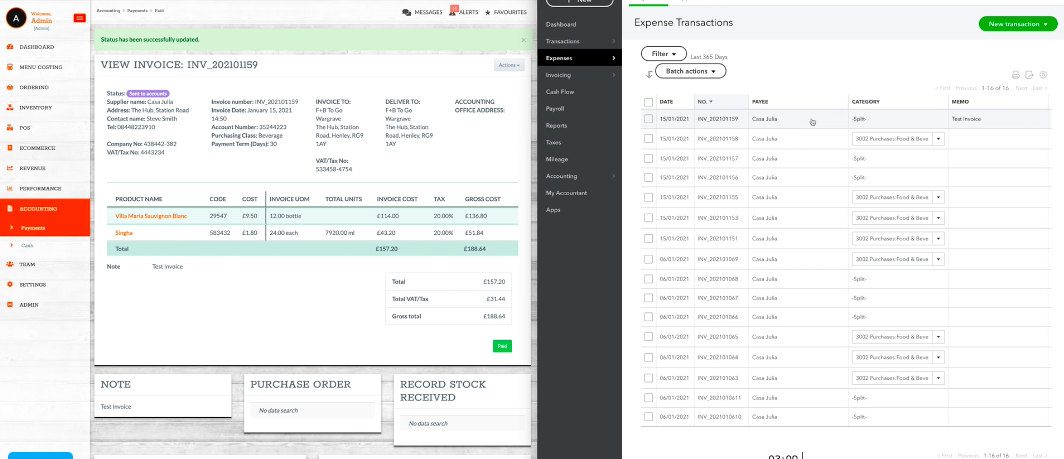

3. Posting the Data

Either by creating new invoice or sending current invoice to accounts;

If creating new invoice - ensure all relevant fields are correctly entered then save by selecting create before sending to accounts

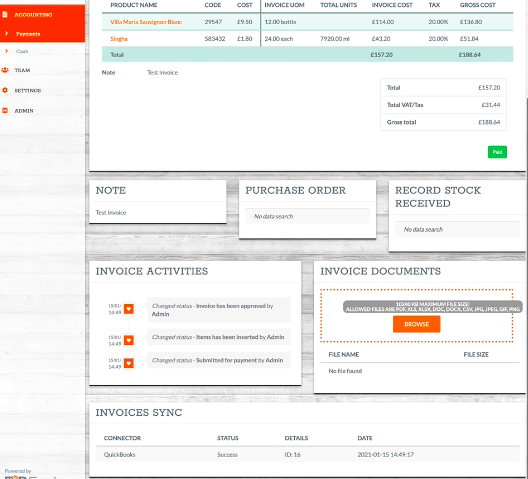

Any invoice that has been sent to accounts should now have a 'success' post against the invoice sync status

Any invoice synced to QuickBooks can be compared by searching the invoice number in the QuickBooks expense transactions page:

Double check to ensure all required and relevant terms are being pulled through from Kitchen CUT accounts to QuickBooks