How to Record Petty Cash Spend

This article details how to make adjustments for your petty cash spend in Kitchen Cut.

If you’ve had to dip into the petty cash jar for a last-minute supermarket run or any ad-hoc purchase, it’s important this spend is recorded accurately to reflect in your Cost of Sales.

This is done by creating a manual adjustment record in the Accounting module.

🧭 How to Record a Petty Cash Adjustment

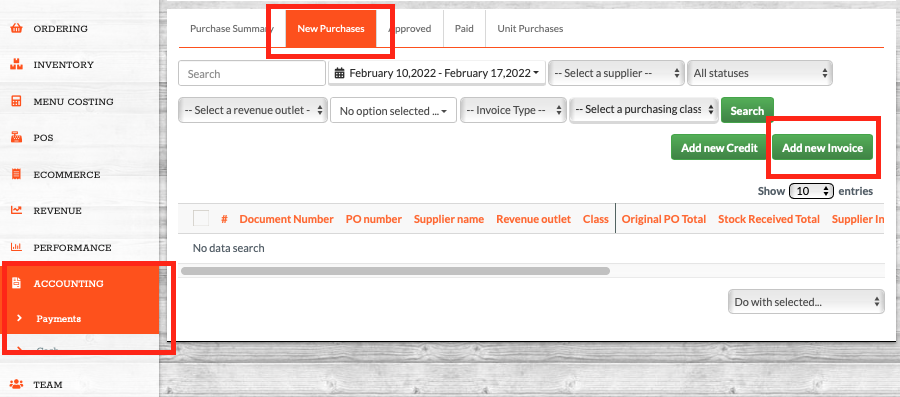

Step 1: Navigate to

Accounting > Payments > New Purchases

Step 2: Click Add New Invoice

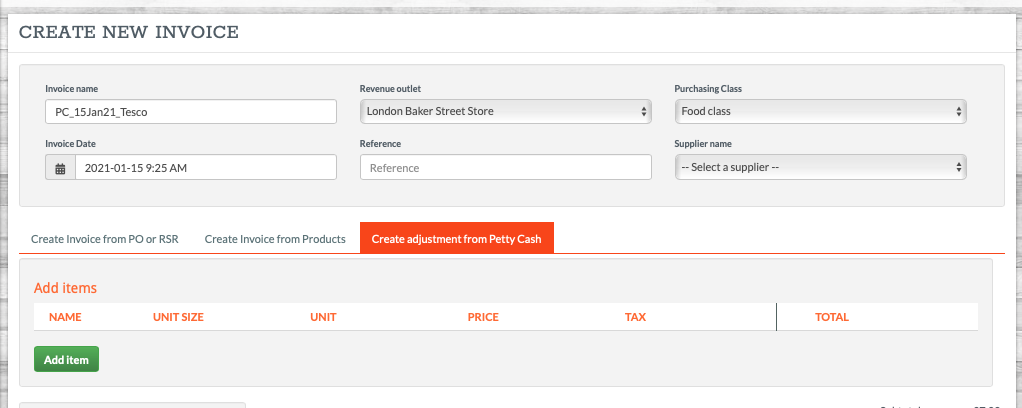

On the invoice creation page, choose the option:

Create Adjustment from Petty Cash

Step 3: Complete the Top Section

-

Reference (optional)

-

Supplier (optional)

-

Date, Class, and Outlet (required)

These details help categorise the expense for reporting purposes.

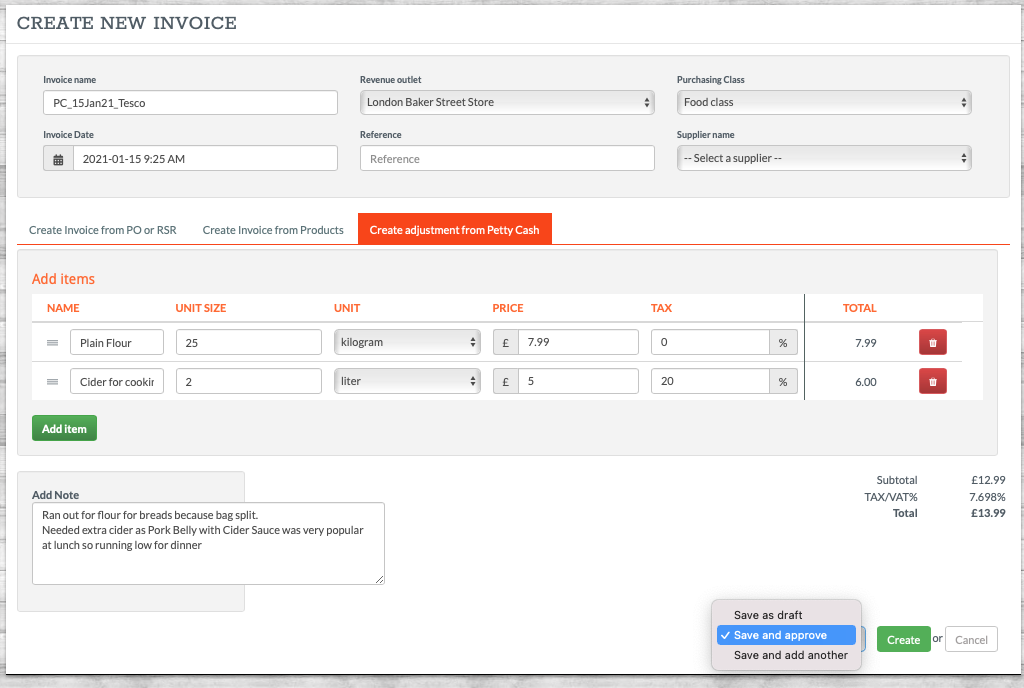

Step 4: Add Your Items

You can now manually enter the items you purchased:

-

Free-text entry – not limited to items already in your system

-

Enter item name, quantity, price, and VAT %

-

Add as many items as needed to this single record

✏️ You can also include a note explaining the nature of the spend (optional but helpful for future reference).

Step 5: Finalise the Entry

Depending on your user permissions, you can:

-

Click Save as Draft – for approval by a senior user

-

Or Save and Approve directly, if your access level permits

Once saved and approved, this petty cash spend will be included in performance reporting.

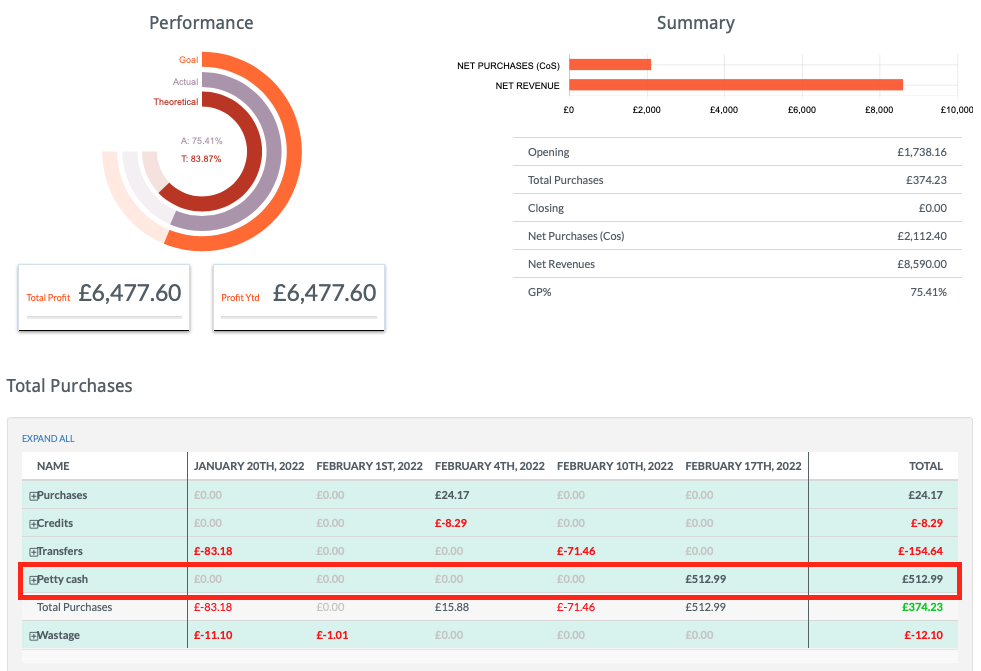

📊 Where Does This Appear?

The spend will show in the:

-

Performance Module → GP Performance Report

-

It will be factored into Total Purchases, affecting your COGS (Cost of Goods Sold)

You can view this in the table breakdown at the bottom of the GP Performance Report.

⚠️ Important Notes

-

Petty cash spend does not affect your stock system.

These items are not added to inventory or counted into theoretical stock holding. -

The assumption is that petty cash purchases are for immediate use, and won’t remain in stock long enough to justify being counted in or out.

-

If some of this stock is still held at the end of the stock period, you may count it under the product it replaced so it reflects in your closing stock value.

💡 Best Practices

-

Always label petty cash records clearly with notes or references to avoid confusion in reporting.

-

Assign the correct class and outlet to keep COGS reporting accurate.

-

Avoid using petty cash for high-volume or repeat purchases — use standard ordering processes instead.

❓FAQs

Do I need to list actual products from my system?

No — petty cash entries are free-text and not tied to your system catalogue.

Will this update my inventory?

No — this is a financial adjustment only and won’t affect stock levels or theoretical stock calculations.

What if I still have petty cash items in stock at the period close?

Count them as if they were the intended replacement product to ensure they’re included in the closing stock value.

🆘 Need Help?

📧 Email Support: support@kitchencut.com

📝 Submit a Ticket: Submit a ticket