How to Export for Sage 50

This article will guide you the the process of exporting for Sage 50

This guide outlines the required configuration steps and the process for exporting invoice data from Kitchen CUT into Sage 50.

Step 1: Configuration Requirements (to be completed in advance)

Before exporting, it’s essential that your Kitchen CUT configuration aligns with your Sage 50 setup. This includes supplier accounts, purchasing categories, cost centres, and tax codes.

The following fields must be correctly populated in Kitchen CUT:

a) Supplier Accounting Identifier

This is the Supplier's Account Reference used in Sage.

Navigate to: Suppliers > Connections > Actions > Edit

Enter the Supplier Accounting Code to match the reference in Sage.

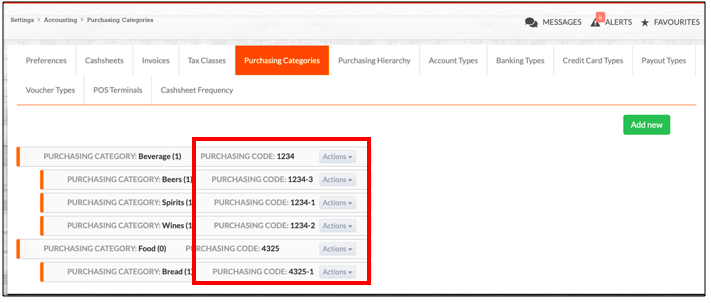

b) Purchasing Category & Codes

This is the Purchasing Code assigned to the category for accounting purposes.

Navigate to: Settings > Accounting > Purchasing > Categories

Create or edit categories and assign the correct purchasing codes.

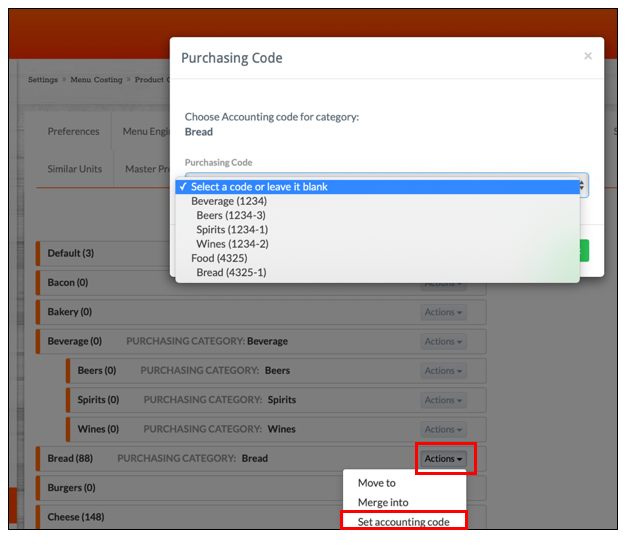

Once created, assign the purchasing categories to your Product Categories:

Navigate to: Settings > Menu Costing > Product Categories > Actions > Set Accounting Code

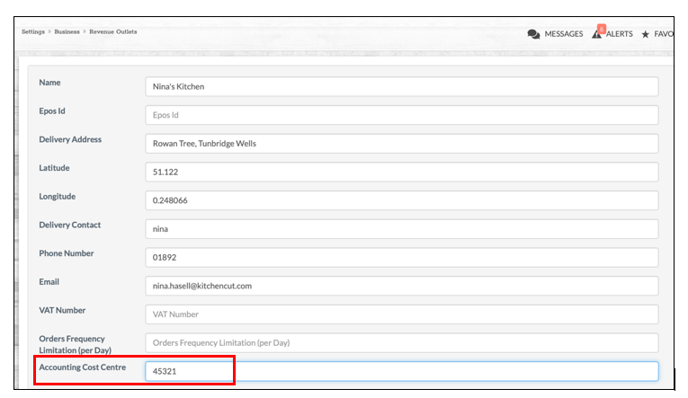

c) Accounting Cost Centre

This corresponds to the Department Code in Sage for each revenue outlet.

Navigate to: Settings > Business > Revenue Outlets > Actions > Edit

Enter the relevant Accounting Cost Centre for each outlet.

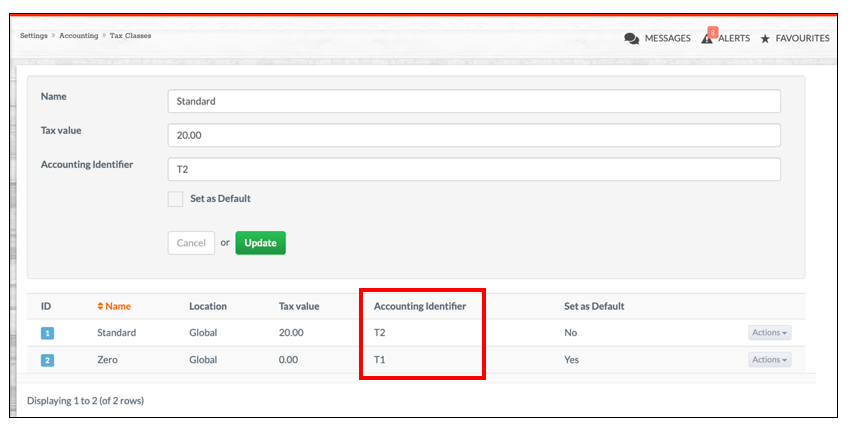

d) Tax Class Profile

This aligns the Tax Code in Kitchen CUT with Sage.

Navigate to: Settings > Accounting > Tax Classes > Actions > Edit

Assign the correct tax code under Accounting Identifier.

Step 2: Exporting a File for Sage 50

Once configuration is complete and a delivery has been received:

-

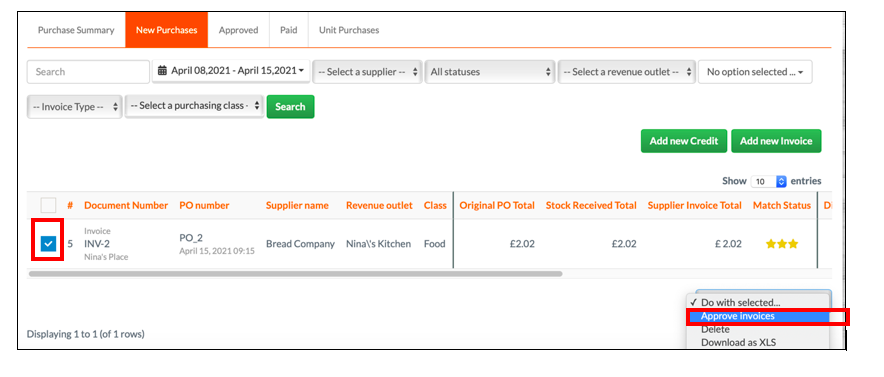

Approve the invoice:

➡️ Go toAccounting > Payments > New Purchases

Review and approve the invoice.

-

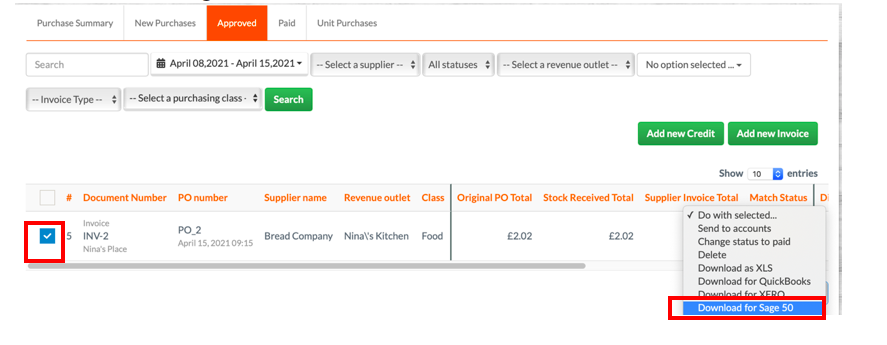

Export the approved invoice:

➡️ Go toAccounting > Payments > Approved

Select the invoice(s) and choose Download for Sage 50 from the dropdown.

Your file is now ready to be imported into Sage 50.

💡 Best Practices

- Always check that Accounting Identifiers and Codes match your Sage setup.

- Complete all invoice approvals in Kitchen CUT before exporting.

- Use consistent naming conventions to reduce errors when importing.

❓ FAQs

What if my supplier isn’t showing an Accounting Code?

Ensure you’ve entered it under Suppliers > Connections > Edit.

Can I re-export an invoice if there was an error?

Yes — you can re-download the file from the Approved tab if changes are made.

Why is my export not importing correctly into Sage?

Double-check all mapped fields and codes for consistency with your Sage configuration.

🆘 Need Help?

📧 Email us at support@kitchencut.com

📝 Submit a support ticket