This article will guide you the the process of exporting for Sage 50

1) Configuration Requirements (to be completed in advance)

It is important to ensure that supplier accounts, purchasing categories, department cost centres and tax codes are aligned with Sage. There are various fields in KitchenCut that need to be configured.

Together the below make up the detail within the export

a) Supplier Accounting Identifier – this is the Suppliers Account reference

Suppliers>Connections>Actions>Edit

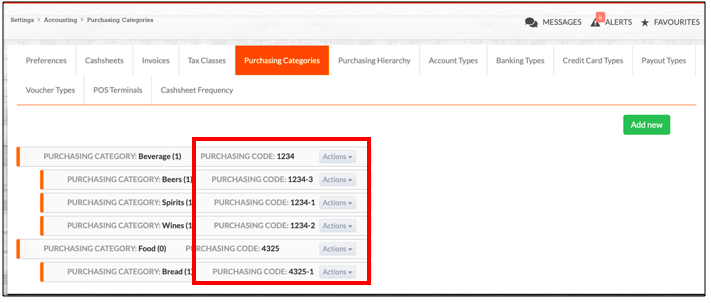

b) Purchasing Category & Codes – this is the Purchasing Code of the for the Purchasing Category

Settings>Accounting>Purchasing>Categories

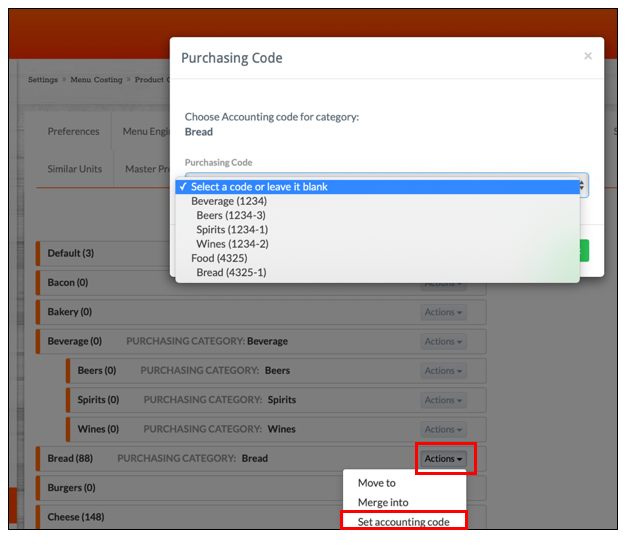

Once you have created the Purchasing Categories you can assign them to the Product Categories

Settings>Menu Costing>Product Categories>Actions>Set Accounting Code

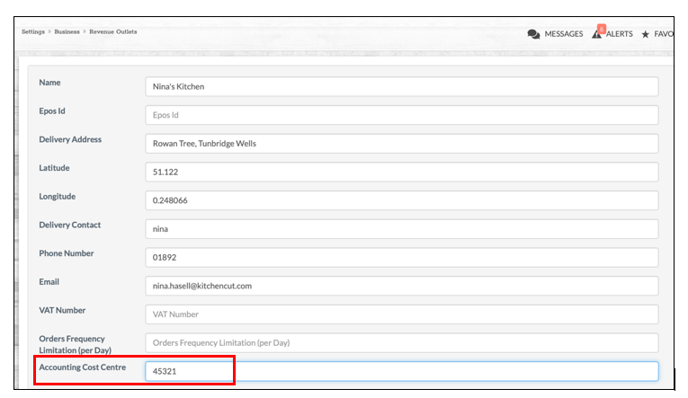

Settings>Business>Revenue Outlets>Actions>Edit

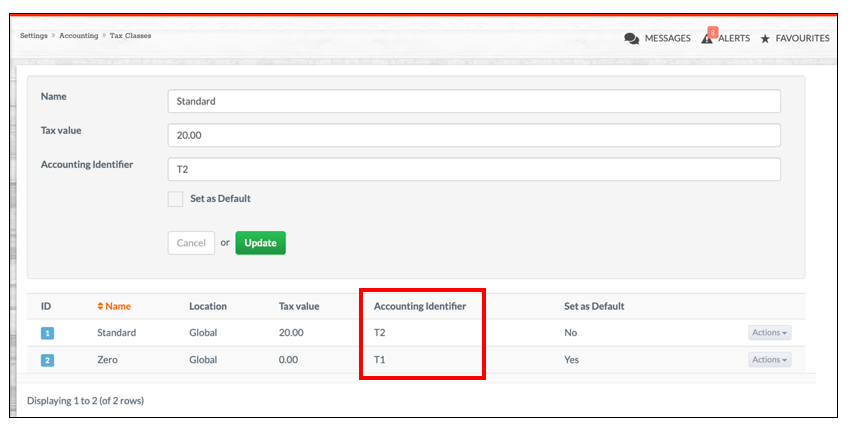

Settings>Accounting>Tax Classes>Actions>Edit

2) Exporting a file to import to Sage 50

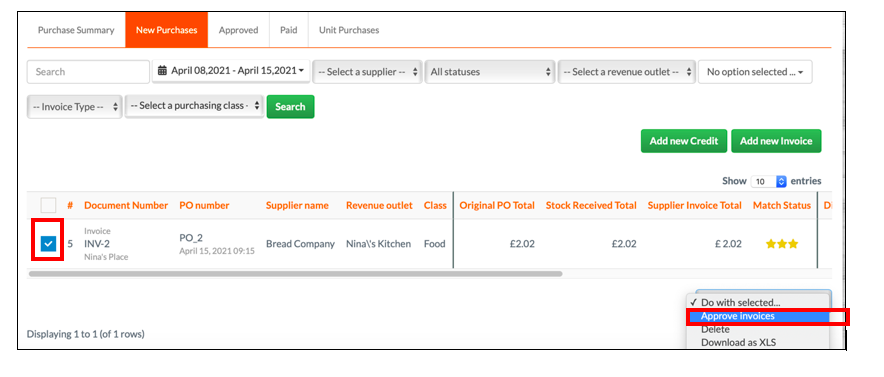

Once a delivery has been received the invoice will be available for you to approve in Accounting>Payments>New Purchases

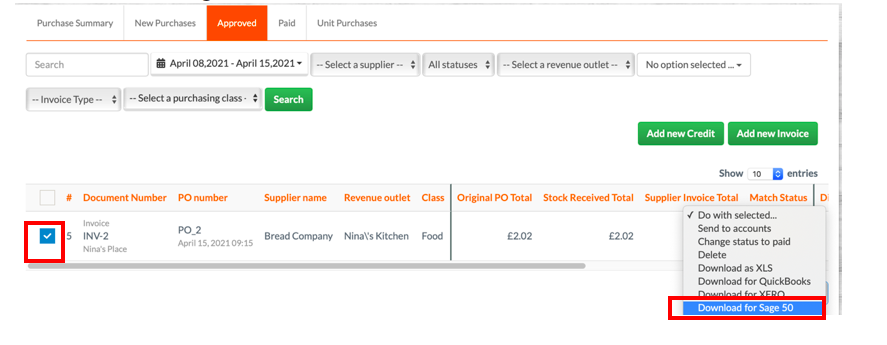

Once you have approved the invoice it will be available in Accounting>Payments>Approved for you to select and ‘Download for Sage 50’

Your download will then be available for you to import into Sage 50